Our Services

Inheritance Recovery

Uncover and claim your rightful inheritance from estates and trusts.

Foreclosure Surplus Recovery

Retrieve excess funds from foreclosure sales that you may not even know are owed to you.

Financial Consultation

Get expert advice on navigating complex financial recovery situations and maximizing your claim.

Our Mission

How Does the Surplus Process Work?

Understanding Surplus Funds

01

When a property is foreclosed and sold at auction, it often sells for more than the amount owed on the mortgage. This excess amount, known as surplus funds, may be rightfully yours. Unfortunately, recovering these funds can be complex and time-consuming without the right assistance.

Evaluation and Documentation

02

Our process begins with a thorough evaluation of your situation. We review the foreclosure sale records and identify any surplus funds that might be due to you. We ensure all necessary documentation is gathered and reviewed to support your claim.

Filing a Claim

03

Once we’ve confirmed the availability of surplus funds, we prepare and file the necessary claim forms with the appropriate authorities. Our team handles all the paperwork and communication to ensure your claim is processed efficiently

Recovery and Disbursement

04

After your claim is approved, we work to ensure that the surplus funds are disbursed to you as quickly as possible. We’ll keep you updated throughout the process and assist with any additional requirements or questions you may have

Review Your Options

Schedule a consultation to discuss your options and understand how we can assist you in recovering your funds.

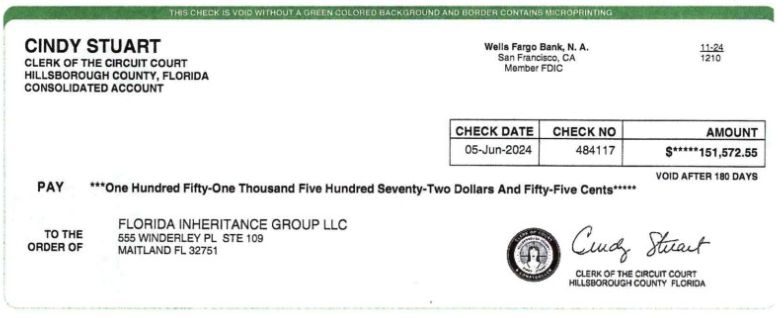

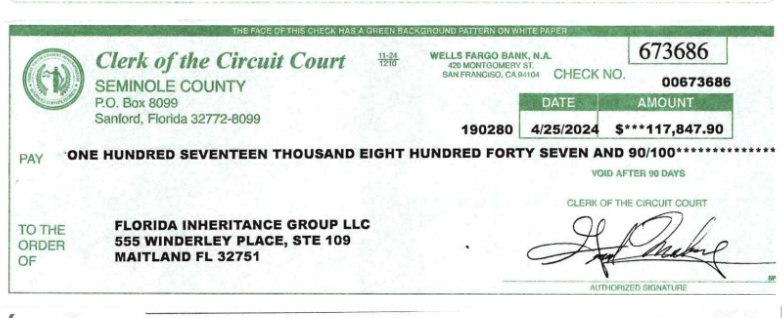

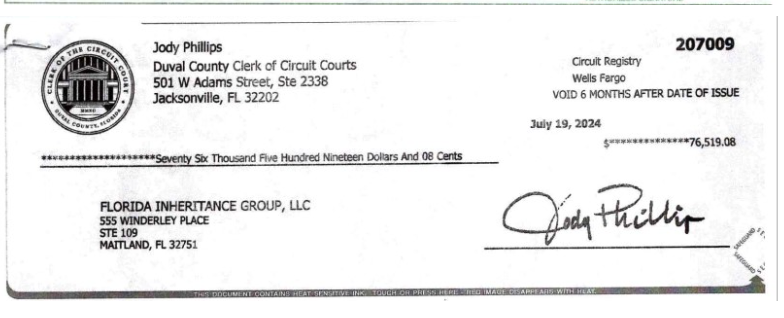

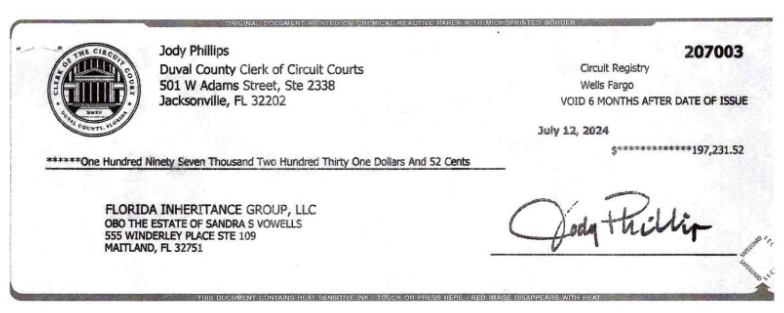

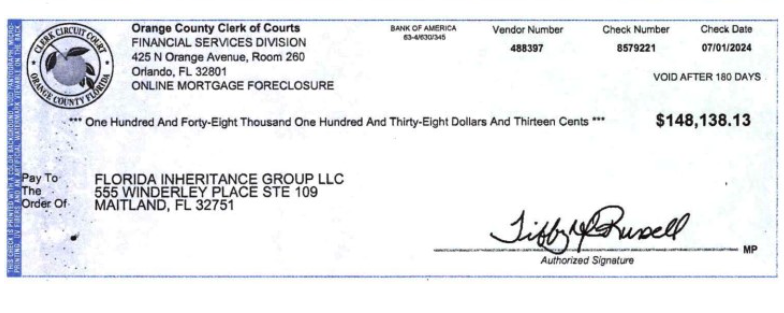

Success Stories

Recent Recoveries See how we've helped clients like

you recover their funds.

Customer reviews and testimonials

EXCELLENTTrustindex verifies that the original source of the review is Google. Yonka Diaz and her team got me all the funds I was entitled to,she was very professional and helpful.Thank you Florida Inheritance Group.Trustindex verifies that the original source of the review is Google. A big help from Yoanka Diaz her and her team really helped out in my case kept me updated and Highly recommendTrustindex verifies that the original source of the review is Google. What a wonderful team. Yoanka goes above and beyond to make sure you get what you deserve!!!!********Trustindex verifies that the original source of the review is Google. Mi experiencia fue muy buena. Se la recomiendo a otras persona, los pueden contratar. Muchas gracias.Trustindex verifies that the original source of the review is Google. Yoanka Diaz is absolutely amazing to work with. She helped my family and I tremendously and was always so informative, kind, and diligent through the entire process. I highly recommend using this company!Trustindex verifies that the original source of the review is Google. We were approached by many of their competitors so by the time Yoanka called our defenses were high. She was so professional, didn’t overwhelm us, explained everything simply and she gained our confidence. She’s a great communicator and kept us apprised of the situation. Everything went seamlessly and we were pleased with the results. We highly recommend working with Yoanka Dias.Trustindex verifies that the original source of the review is Google. Encantada con el servicio. Yoanka es excellente, es una persona bien comprometida con su trabajo, y .su profecionalismo y eficiencia son extraordinarios. Yoanka te aclara toda duda y brinda paz en esos momentos cuando no sabes que hacer. Estoy plenamente agradecida. Que Dios la bendiga siempre. La recomiendo, porque pudes confiar en ella. Otras compañias no te hablan con la verdad, pero ella si lo hara.Trustindex verifies that the original source of the review is Google. We hired Florida Inheritance Group to settle our debt / inheritance. They did a phenomenal job. The company encouraged us not to accept a quick offer and to wait the course for the inheritance.Trustindex verifies that the original source of the review is Google. Mi experiencia con Florida Inheritance Group fue excelente. Fueron muy profesionales y me mantuvieron al tanto en el proceso. Además, fue más rápido de lo que esperaba. Gracias Yoanka 😃

Questions & Answers

Surplus funds, also known as “overage” or “excess funds,” arise when a property sells at auction for more than the amount owed during a foreclosure process. This type of foreclosure could be due to an association, mortgage, or tax-deed foreclosure. When the property sells for a higher price than the foreclosure amount, the additional money is considered a surplus. These surplus funds rightfully belong to the original homeowner or their heirs.

To collect surplus funds, a motion usually needs to be filed with the court. You can hire an attorney independently, but this can be quite expensive since attorneys typically charge an hourly rate, which you will have to pay out-of-pocket regardless of the outcome. Alternatively, you might find an attorney who works on a contingency basis, but their fees can be as high as 30% or more.

For more complex claims, our attorneys at Florida Inheritance Group work diligently to establish you as the rightful recipient of these funds and ensure that the court orders the release of these funds by the agency holding them.

When you work with Florida Inheritance Group, all attorney’s fees and related expenses are covered by us. There are no out-of-pocket expenses for you. We operate strictly on a contingency basis, meaning we only get paid when you get paid. If we are unable to recover any funds on your behalf, our services are completely free of charge!

You may be entitled to surplus funds if a property you owned has undergone foreclosure or a tax sale. When a property is sold through these processes, it often sells for more than the amount owed. The excess money from the sale is considered surplus funds. Additionally, if you are an heir to a property that has gone through a foreclosure or tax sale, you may also be eligible to claim these funds. Florida Inheritance Group identifies rightful claimants, ensuring that the funds are directed to the appropriate parties, whether they are the original property owners or their heirs.

The funds we are contacting you about are held in the county court registry. They originate from an association foreclosure, mortgage foreclosure, or tax-deed foreclosure sale. When a property is sold at auction for more than the amount owed during foreclosure, the extra money is termed “surplus funds.” These funds are now available for the rightful claimants, which could be the original property owner or their heirs. Florida Inheritance Group is here to help you claim these surplus funds.

If you are not the owner of record, it is likely because you have been identified as an heir to that person. When a property owner passes away and their property goes through foreclosure, the heirs of the deceased owner are entitled to claim the surplus funds. This might include spouses or children, but in Florida, if someone dies without a will (intestate), there are specific rules that determine the heirs. At Florida Inheritance Group, our account specialists will guide you through the process and explain how you are entitled to these funds. Rest assured, we are experts in this field and have identified you as the rightful claimant.

The short answer is, no!

If the mortgage was not named in the foreclosure case, they cannot claim the surplus funds. Even if they are the plaintiff in the foreclosure, they cannot claim the surplus because they have already been paid in full from the proceeds of the sale. If they were not named in the foreclosure, they cannot claim the surplus because they still hold a “senior” lien on the property and were not “foreclosed” upon. The buyer at auction purchased the property with that mortgage still attached, meaning the new owner is now responsible for the mortgage. Therefore, you are clear to have Florida Inheritance Group claim the funds on your behalf.

You have one year to claim the funds from your foreclosure sale before they are transferred to the Florida treasury. While it’s still possible to claim them after this period, the process becomes much more complex and time-consuming. It’s best to collect the funds within the first year.

The biggest issue isn’t the funds being lost to the county or state, but rather the risk of fraud. Some individuals monitor these cases and, if no claim is filed within the first few months, they may fraudulently attempt to claim the funds themselves, even forging your signature on documents.

At Florida Inheritance Group, we have experience dealing with such fraudulent claims and have successfully helped homeowners recover their funds. We ensure the rightful owner receives the surplus funds promptly and securely.

No, you won’t need to pay anything upfront if you use the services of Florida Inheritance Group. We cover all costs and fees associated with processing your claim. We only receive payment after we have successfully secured the funds on your behalf. All details regarding our fees and payment terms will be clearly outlined in your agreement with us.

If you decide not to claim the funds, they will eventually be sent to the Florida Department of Treasury. However, unlike in some other states, these funds do not “escheat” or become permanently the property of the state; they remain claimable indefinitely in Florida.

If you prefer not to keep the funds yourself, Florida Inheritance Group can assist you in directing them to a charitable cause. We can partner with one of our affiliated charities that support homeowners facing foreclosure, or we can work with a charity of your choice to ensure the funds are donated appropriately.

Yes, you can still claim the funds even if you are on Social Security, Medicaid, or other fixed income support. It’s important to discuss your situation with your recovery specialist at Florida Inheritance Group. If necessary, we will engage an attorney on your behalf to ensure that claiming your surplus funds does not impact your income-based support or benefits.

If your home is facing HOA foreclosure, you may still be entitled to surplus funds. Generally, a mortgage takes precedence over an HOA lien. This means that even if your home is sold to satisfy the HOA’s debt, you could potentially receive any remaining funds after the mortgage and other prioritized claims are paid.

However, determining your eligibility for surplus funds requires a careful analysis of your specific situation. Our legal team at The Florida Inheritance Group specializes in complex property matters and can help you understand your rights and options.

The possibility of other liens or mortgages affecting your claim to surplus funds depends on several factors, including which parties are involved in the foreclosure lawsuit.

To provide a clear understanding of your specific situation, our legal team at The Florida Inheritance Group offers complimentary consultations. In many cases, liens or mortgages not included in the foreclosure proceedings may not have a claim on potential surplus funds.

Ready to Get Started?

Have questions or need assistance? Our team is here to help.

Reach out to us at 407-917-0242 or visit floridainheritancegroup.com to get in touch.